Unlocking Success with Prop Trading Firms: The Future of High-Performance Trading

In the dynamic world of financial markets, the emergence and rapid growth of prop trading firms have revolutionized the way trading professionals operate. These firms, often characterized by their cutting-edge technology, innovative strategies, and empowering environments, are redefining the standards of profitability, risk management, and trader development. As the financial landscape continues to evolve with technological advancements and market complexities, prop trading firms stand at the forefront of this transformation, offering unparalleled opportunities for traders and investors alike.

Understanding Prop Trading Firms: What Sets Them Apart?

Prop trading firms, short for proprietary trading firms, are organizations that utilize their own capital to trade in financial markets. Unlike traditional asset managers or hedge funds that operate on clients’ money, prop firms absorb all the trading risks and rewards. This unique structure allows them to foster an environment of innovation, agility, and high performance.

Key Characteristics of Prop Trading Firms

- Ownership of Capital: Firms trade using their own funds, aiming for high profitability while managing risk effectively.

- Structured Trading Programs: They often develop structured training and mentoring programs to cultivate new traders.

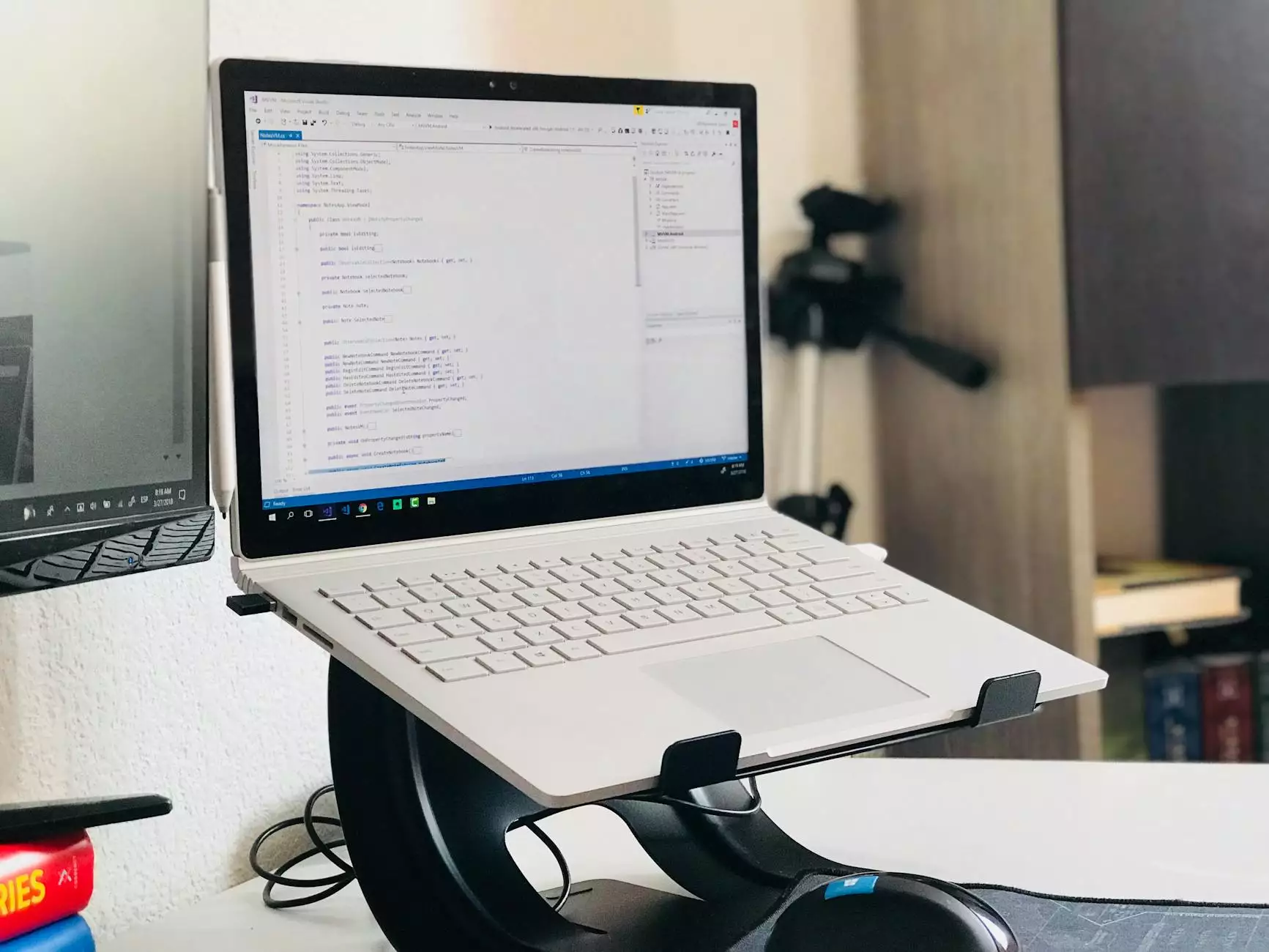

- Advanced Technology Adoption: Use of state-of-the-art trading platforms, algorithmic tools, and data analysis techniques.

- Performance-Based Incentives: Traders are typically compensated based on their performance, fostering motivation and accountability.

- Risk Management Focus: Rigorous risk controls and compliance measures ensure sustainable profitability.

The Rise of Prop Trading Firms in the Global Financial Ecosystem

The proliferation of prop trading firms is a direct response to the increasing demand for sophisticated trading strategies and risk management techniques. These firms have become pivotal players in the financial markets, not only providing liquidity but also driving innovation in trading technology and approaches.

Several factors contribute to the rapid growth and global spread of prop trading firms:

- Technological Revolution: The rise of high-frequency trading, machine learning, and big data analytics has transformed how trades are executed and optimized.

- Market Accessibility: Cloud computing and online trading platforms have democratized access to global markets for ambitious traders.

- Increasing Complexity of Markets: Complex and volatile markets require advanced strategies that prop firms are well-equipped to develop and implement.

- Financial Regulatory Environment: While regulations have increased, many prop firms have adapted by adopting best practices in compliance and risk control.

- Talent Acquisition and Development: The ability to attract and nurture top trading talent is a critical competitive advantage for these firms.

Why Traders Choose Prop Trading Firms: The Benefits and Opportunities

Joining a prop trading firm offers a distinctive set of advantages that can accelerate a trader’s career and maximize earnings potential. Here are some compelling reasons why traders prefer to work with these innovative entities:

Access to Substantial Capital

One of the most significant benefits is access to the firm's capital. Traders do not need to risk their personal funds, which means they can execute larger trades, explore diverse strategies, and capitalize on more opportunities without the constraints of limited personal capital.

State-of-the-Art Technology and Infrastructure

Prop firms invest heavily in cutting-edge technology, providing traders with access to powerful trading algorithms, advanced charting tools, real-time data feeds, and lightning-fast execution platforms. This technological edge often gives traders a competitive advantage in volatile markets.

Structured Training and Mentorship Programs

Many prop trading firms offer comprehensive training modules, mentorship, and continuous education, allowing novices to develop their skills under seasoned professionals' guidance—accelerating learning curves significantly.

Performance-Based Compensation

Traders often earn lucrative payouts based on their performance, incentivizing high performance, discipline, and innovative trading strategies. This profit-sharing model aligns the interests of traders and firms for mutual success.

Flexibility and Autonomy

While the structure varies, many prop firms allow traders a degree of autonomy in strategy development, fostering a culture of innovation and personalized trading approaches.

Risk Management and Sustainability in Prop Trading Firms

Effective risk management is the backbone of any successful prop trading firm. These firms implement rigorous risk controls to ensure profitability is sustainable over the long term, even during turbulent market conditions.

Some key risk management techniques employed include:

- Strict Position Limits: To prevent excessive exposure to any single asset or market.

- Real-Time Monitoring: Continuous surveillance of open trades and market conditions to identify and address risks promptly.

- Advanced Algorithms: Use of predictive analytics and automated stops to limit losses.

- Diverse Strategies: Developing multiple strategies to reduce dependency on any single approach.

- Regulatory Compliance: Ensuring all trading activities meet the prevailing financial regulations to avoid penalties and reputation damage.

How Prop Trading Firms Contribute to Market Liquidity and Efficiency

Beyond offering lucrative opportunities for individual traders, prop trading firms play a crucial role in enhancing market liquidity and efficiency. By continuously engaging in buying and selling activities, they contribute to tighter bid-ask spreads and ensure smoother market functioning.

Moreover, their technological innovations often lead to newer, faster trading methods, benefiting the broader market ecosystem. This symbiotic relationship illustrates how prop firms are not just profit-driven entities but active participants in strengthening the financial markets.

The Future of Prop Trading Firms: Trends and Innovations

The landscape of prop trading firms is constantly evolving in response to technological advancements, regulatory changes, and market dynamics. Several emerging trends are shaping the future of this industry:

Adoption of Artificial Intelligence and Machine Learning

Utilizing AI-driven models for pattern recognition, predictive analytics, and automated decision-making will become increasingly prevalent, enabling traders to identify opportunities faster and more accurately.

Integration of Blockchain and Decentralized Finance (DeFi)

Blockchain technology offers transparency, security, and efficiency, which can revolutionize how prop firms operate and manage trades, particularly in emerging DeFi markets.

Enhanced Risk Management Solutions

Next-generation risk controls, powered by big data analytics and real-time monitoring, will ensure even greater safeguards against market downturns and unexpected volatility.

Global Expansion and Diversification

Tech-enabled connectivity allows prop trading firms to expand into new geographic markets, diversify assets, and explore alternative trading instruments, further advancing their competitive edge.

Conclusion: Embracing the Power of Prop Trading Firms for Financial Success

The rapid rise and continuous innovation in prop trading firms highlight their vital role in shaping modern financial markets. These organizations not only provide traders with access to substantial capital and cutting-edge technology but also foster a culture of high performance, innovation, and risk management. For aspiring traders and seasoned professionals alike, engaging with a prop trading firm offers unparalleled opportunities for growth, profitability, and mastery of the trading craft.

As markets become more complex and technology-driven, the importance of prop trading firms will only grow, serving as catalysts for market efficiency and financial innovation. Whether you're looking to elevate your trading career or leverage the advantages of professional trading environments, understanding the power and potential of prop trading firms is essential for future success in the fast-paced financial world.